A decent FICO rating is fundamental, from applying for a line of credit to leasing a condo. Nonetheless, it can take a great deal of work to bring your FICO rating up in a short measure of time. Luckily, there are a few procedures you can use to support your FICO rating effectively_._

This blog entry will examine 7 ways to bring your financial assessment up in record time. Peruse on to more deeply study how to work on your cibil score and open new open doors.how to increase credit score with 7 ways

Table of Contents

What is a Good Credit Score?

A decent FICO rating is fundamental for getting to monetary administrations in India, like applying for a line of credit or applying for a charge card. A decent financial assessment is likewise important to get the wellbeing rates and terms while getting to monetary administrations.

How to increase credit score

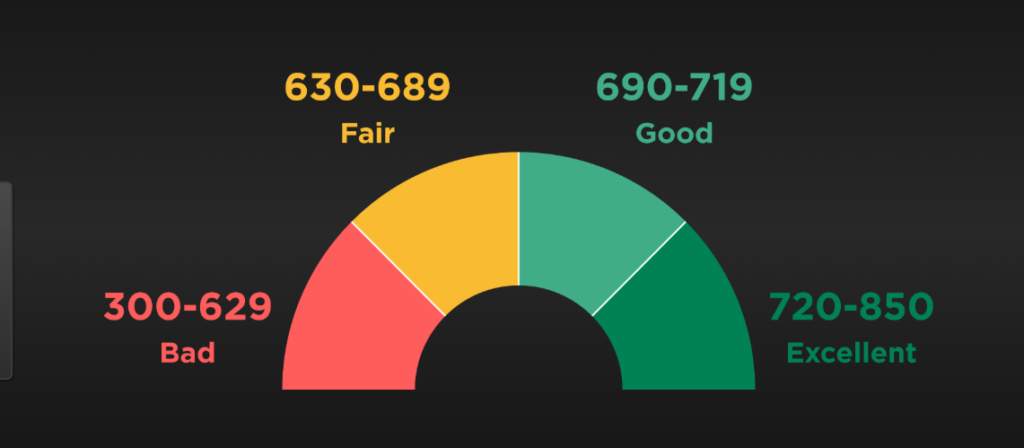

All in all, what is a decent FICO rating in India? Financial assessment goes from 600 to 750 or more. This is the way credit still up in the air:

Magnificent FICO rating: A FICO rating of 750 or more is viewed as great.

Great financial assessment: 700 to 749 is viewed as great.

Fair financial assessment: 650 to 699 is viewed as fair.

Unfortunate FICO assessment: 600 to 649 is viewed as poor.

Note: It is vital to recollect that financial assessments can fluctuate between loan specialists.

https://happycredit.in/blog/how-to-increase-cibil-score

Best Ways to Increase Your Credit Score

There are many different ways in case you are looking for ways on how to increase cibil score. Let’s take a brief overview of some of them.

1. Check Your Credit Report for Errors

Checking your credit report for mistakes is a successful approach to further developing your FICO assessment. In India, CIBIL (Credit Data Agency India Restricted) offers free admittance surprisingly report.

Check your report and question any mix-ups that could adversely influence your score. In the event that you view as any, contact CIBIL promptly to get your score moved along.

2. Make All Your Payments on Time

It is basic to make your installments on opportunity to further develop your FICO assessment in India. The sooner you make your installments, the better your FICO rating will be. In the event that you can’t make installments on time, you will be punished, and your FICO rating will drop. Keep away from punishments, set up programmed installments if conceivable, or make updates for yourself, so you don’t miss installments.

3. Reduce Your Credit Card Balances

Having a lot of Visa obligation can haul down your FICO rating. Keeping your Mastercard adjusts low is fundamental to keep a decent FICO rating.

To decrease your Visa adjusts, follow a couple of tips:

Begin by Making a Spending plan: Figure out what you can manage the cost of every month and focus on taking care of your Visas with the most elevated loan fees first.

Moving Your Visa Equilibrium: You can likewise solidify your Mastercard obligation or move your equilibrium to a low-premium charge card, getting a good deal on interest installments and making it simpler to take care of your obligation.

Monitor Your Spending: Monitor the amount you spend on your Mastercards. Use money or check cards at whatever point conceivable to try not to pile up unpaid liability on your Mastercards. When you fix your equilibriums, your FICO assessment ought to work on over the long run.

4. Have a Mix of Different Types of Credit

On the off chance that you have an inquiry with respect to how to build your FICO rating in India, one of the ways of doing so is by joining various kinds of credit. This implies having a blend of gotten and unstable advances and a combination of charge cards and other monetary means.

Various sorts of credit incorporate rotating acknowledge, for example, Mastercards and store cards; portion acknowledge, for example, understudy loans and vehicle advances; and administration acknowledge, for example, service bills and mobile phone bills. Having numerous types of credit can further develop your financial assessment by showing the way that you can mindfully oversee different kinds of obligation.

5. Don’t Open New Credit Cards Unnecessarily

Another critical thing to consider when trying to find an answer to how to improve credit score is avoiding the temptation to open new credit cards unnecessarily. Credit cards can be tempting, especially if they offer lucrative rewards programs or low-interest rates. However, applying for too many cards and not managing them can adversely affect your credit score.

6. Keep Old Accounts Open

One more method for expanding your FICO assessment in India is to keep your old records open. This might sound outlandish, yet it is an incredible method for showing moneylenders that you have reliably been mindful with your funds. At the point when you keep an old record open, it shows banks that you have a long history of making ideal installments. It likewise shows that you have had a positive relationship with loan bosses for quite a while, which can assist with helping your FICO rating.

7. Use Credit Counseling Services

Credit counselling services can help you manage your finances better, provide advice on how to increase cibil score, and assist you in navigating the process of improving your score. Counselling services can help you create a budget, give you tips on how to manage your debt and credit cards more efficiently, and help you improve your financial literacy.

FAQs

Q. What is the typical time it assumes to fabricate praise from 500 to 700?

Ans. Luckily, further developing a low FICO rating can require somewhere in the range of 12 and year and a half of dependable credit propensities.

Q. Is there a credit proviso?

Ans. 609 Question Letters are frequently alluded to as a credit fix stunt or legitimate proviso since they empower you to have negative things eliminated from your credit reports.

Q. What is the ideal number of Visas to have?

Ans. Notwithstanding different kinds of credit, a few Visas are by and large prescribed to further develop your credit blend so your FICO rating can get to the next level.

Q. Which slip-up kills credit the most?

Ans. Covering your bills late is quite possibly of the most widely recognized way your FICO assessment is adversely impacted.

Q. Is it terrible for your FICO rating on the off chance that you don’t utilize a Mastercard?

Ans. Your score isn’t impacted by not utilizing your Mastercard. Notwithstanding, your backer could ultimately close the record as a result of latency, bringing down your general credit accessible.